Mark wants to double your money.

Seriously, he’s offering to double it.

Not only that, but he’s also offering you a piece of his company.

Who is this guy? And is his offer worth exploring?

Let’s take a look…

Meet Mark

This is Mark Samuel.

Mark is Founder & CEO of a company called Mark’s Snacks, which sells a line of healthy, kettle-style potato chips.

His chips are made from American-grown potatoes and cooked in avocado oil.

There are no hard-to-pronounce ingredients and no artificial flavors here — just simple kettle chips offered in three flavors:

Mark’s a lifelong health and fitness enthusiast. He’s also an accomplished entrepreneur, where he’s had notable success in the “healthy-eating” sector.

A startup he launched that created meal-preparation kits was acquired. And in 2016, he founded a snack company whose products are now sold nationwide in Whole Foods, Wegmans, and Vitamin Shoppe.

Clearly, Mark’s found his calling.

And now he’s focused on a new product that’s exploding in popularity…

A $50 Billion Market

Last year, snack-food sales in the U.S. surpassed $50 billion. Today, salty snacks alone — popcorn, pretzels, and kettle chips like Mark’s — comprise a $33 billion market.

The thing is, consumers aren’t just snacking more these days; they’re snacking healthier.

According to Trax Retail, 71% of Americans say they’re choosing healthier snacks. And 61% are willing to pay more for better-for-you options.

Data shows that more than half of all consumers seek healthy ingredients in their snacks. Factors like sustainable ingredients and clean-label credentials are important, too.

This desire for healthier options might explain why acquisitions of health-focused snack brands have ticked up, including a few that have featured big price tags. For example:

- Last October, PepsiCo acquired Siete Foods, makers of a healthier tortilla chip, for $1.2 billion.

- In January 2025, Simple Mills, makers of healthy crackers, was acquired by Flower Foods for $795 million.

- Four months later, Lesser Evil popcorn was acquired by Hershey’s for $750 million.

Could Mark’s Snacks one day join the list of acquired brands?

Sales Are About to Start

Mark’s line of chips will hit store shelves later this year.

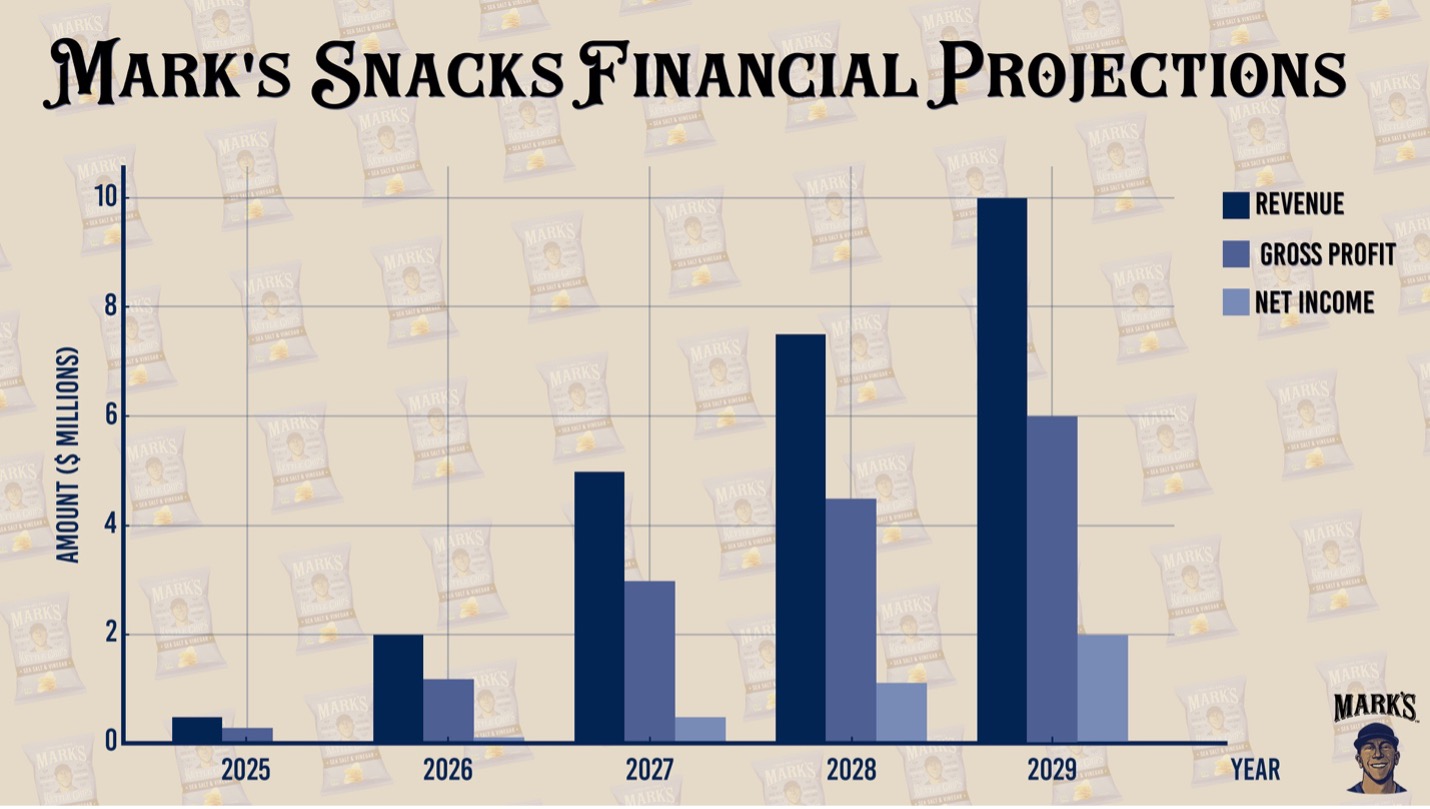

From there, sales are projected to start climbing. Take a look:

Between 2025 and 2029, the company is forecasting total sales of about $25 million (more on this figure in a moment). But before these chips hit the market, the company needs capital to jumpstart production…

And you’re invited to invest.

Here are the details.

Investment Opportunity

This is an opportunity to earn equity in a startup — and a piece of its future sales.

You see, Mark’s company is offering what’s called a revenue-sharing deal. Essentially, you’ll loan the company money, and it will pay you back directly from its revenues.

Specifically, investors will earn 2% of the company’s gross revenues each quarter until they recoup twice their investment. In other words, this is a chance to double your money.

But how long will it take the company to pay you back?

Crunching the Numbers

Let’s assume the company raises the full $250,000 it’s seeking. In that case, the company would need to pay investors back twice that amount ($500,000) from 2% of its gross sales.

For $500,000 to equal 2% of gross sales, sales would need to reach $25 million. (2% of $25 million is $500,000.)

If you recall, the company aims to reach $25 million in cumulative sales by 2030. So potentially, you could double your investment in just five years. That would equal an annualized return of more than 14%.

With most revenue-sharing deals, once your investment is paid in full, you’re no longer considered an investor in the company. But in this case, in addition to a cut of revenues, you’ll also earn a piece of the company at a $5 million valuation.

In other words, if this company becomes the next acquisition target in the snacks market, you could earn your revenue shares… plus a windfall of profits.

This is an exciting opportunity. But it’s not risk-free…

Know the Risks

For starters, the company hasn’t started sales yet.

Furthermore, the competition for healthy snacks is fierce. Mark will have to do something unique to stand out from the crowd.

Finally, $25 million in sales within five years is just a projection — it’s not guaranteed. The longer it takes for sales to climb, the longer it’ll take you to earn your 2x return. And that will impact your return on investment.

Still, if you’re intrigued by this line of healthy snacks — and you like the idea of potentially doubling your money and then some — click here to learn more »

Happy snacking, and happy investing.

Best Regards,

Editor

Crowdability.com